Business Insurance in and around Dayton

Calling all small business owners of Dayton!

This small business insurance is not risky

Your Search For Reliable Small Business Insurance Ends Now.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like a staff member getting hurt on your business's property.

Calling all small business owners of Dayton!

This small business insurance is not risky

Cover Your Business Assets

With options like a surety or fidelity bond, worker's compensation for your employees, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Richard Keller is here to help you customize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and contact State Farm agent Richard Keller's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

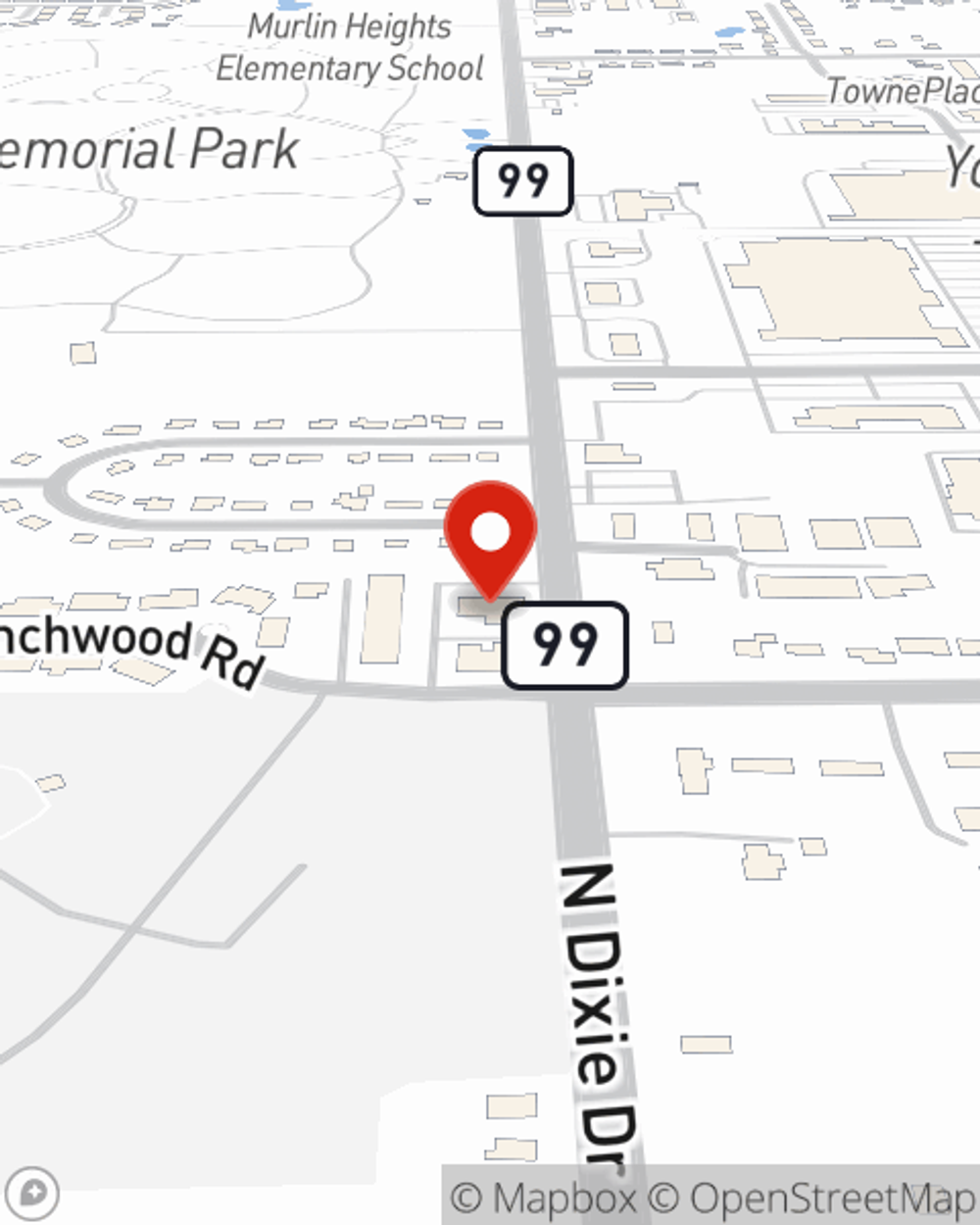

Richard Keller

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.